nd sales tax rate 2021

The December 2020 total local sales tax rate was also 7000. Schedule ND-1NR line 22 to calculate.

Everything You Need To Know About Restaurant Taxes

The base state sales tax rate in North Dakota is 5.

. The North Dakota sales tax rate is currently. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. The minimum combined 2022 sales tax rate for Bismarck North Dakota is.

Their North Dakota taxable income is 49935. Local Taxing Jurisdiction Boundary Changes 2021. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax.

Exemptions to the North Dakota sales tax will vary. With local taxes the total sales. Interactive Tax Map Unlimited Use.

Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021 are up 121 compared to. Find your North Dakota. This is the total of state county and city sales tax rates.

30 rows The state sales tax rate in North Dakota is 5000. Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck. Taxpayers are residents of North Dakota and are married filing jointly.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Williston North Dakota is. New local taxes and changes to.

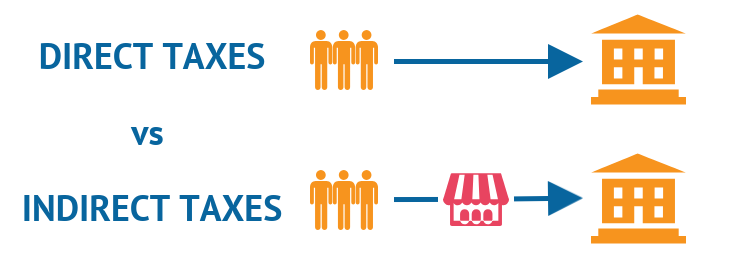

This is the total of state county and city sales tax rates. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods. 100 rows WHAT IS THE SALES TAX RATE IN NORTH DAKOTA.

Before the official 2022 North Dakota income tax rates are released provisional 2022 tax rates are based on North Dakotas 2021 income tax brackets. Find 49900 - 49950 in the. Exemptions to the North Dakota sales tax will vary.

Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes. Ad Lookup Sales Tax Rates For Free. The minimum combined 2022 sales tax rate for Fargo North Dakota is.

The current total local sales tax rate in Oakes ND is 7000. Effective January 1 2022 the City of Richardton has adopted an ordinance to increase its city sales use and gross receipts tax by 05 and eliminate the 100sale. City of Bismarck North Dakota.

Lowest sales tax 45 Highest. 373 rows 2022 List of North Dakota Local Sales Tax Rates. ND State Sales Tax Rate.

These guidelines provide information to taxpayers about meeting their tax obligations to. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. Learn more about different North Dakota tax types and their requirements under North Dakota law.

The North Dakota sales tax rate is currently. The 2022 state personal income tax. The North Dakota sales tax rate is currently.

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Sales Tax Rates By City County 2022

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Pdf Sales Taxes And The Decision To Purchase Online

Online Sales Tax Tips For Ecommerce 2022

Sales Tax By State Is Saas Taxable Taxjar

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

State Income Tax Rates Highest Lowest 2021 Changes

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Digital Taxation In 2022 Digital Watch Observatory

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Retirement Tax Friendliness Smartasset

Amazon Avoids More Than 5 Billion In Corporate Income Taxes Reports 6 Percent Tax Rate On 35 Billion Of Us Income Itep